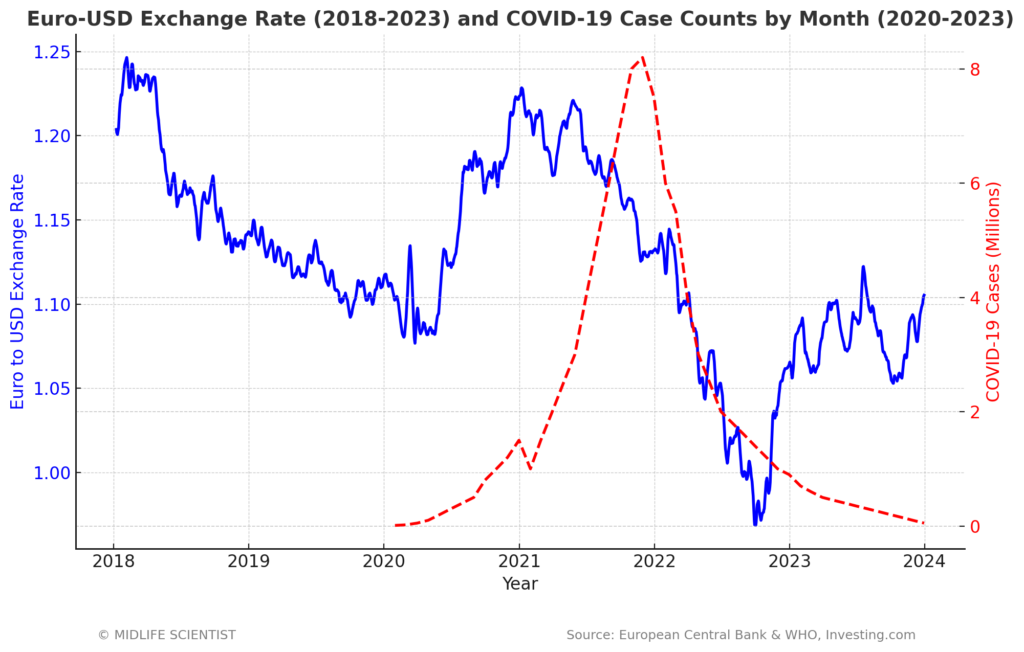

In this post, I’m diving into the relationship between the Euro-USD exchange rate from 2018 to 2023 and the impact of the COVID-19 pandemic. I’ve plotted two key datasets in the chart above: the Euro to USD exchange rate over the five-year period and the monthly COVID-19 case counts from 2020 to 2023. Given that the United States had the highest case count during the pandemic, with over 104 million confirmed cases, the U.S. dollar and its fluctuations provide a particularly insightful lens through which to examine how the pandemic shaped financial markets and currency values during this volatile time.

Euro-USD Exchange Rate (2018-2023)

The blue line on the chart represents the Euro-USD exchange rate over five years. As one of the most widely traded currency pairs globally, fluctuations in this rate have far-reaching implications for trade, investment, and overall economic stability.

Starting in 2018, the Euro was relatively strong against the USD, with values around 1.20. Over the next two years, I noticed a gradual decline as the Euro weakened, eventually falling to about 1.10 by the end of 2019. This dip can be attributed to several factors, including ongoing uncertainties in the Eurozone and global trade tensions.

The COVID-19 Pandemic: Initial Impact

The red dashed line on the chart tracks the number of COVID-19 cases by month, with a steep rise starting in early 2020 as the pandemic unfolded. During this time, global markets faced significant volatility, and the Euro-USD exchange rate dropped sharply from around 1.12 in early 2020 to below 1.08 by mid-year. Despite this initial drop, the exchange rate rebounded quickly and even climbed above 1.20 by the end of 2020. This pattern suggests that while the initial shock of the pandemic affected currency markets, the rapid economic stimulus measures taken by central banks and governments helped stabilize and later strengthen the Euro during the latter part of the year.

Pandemic Peaks in Late 2021

The chart reveals a notable spike in COVID-19 cases toward the end of 2021, particularly in December, when cases hit their peak at over 8 million. This was driven by the emergence of new variants, leading to renewed lockdowns and restrictions in many parts of the world.

During this period, I observed that the Euro started to experience more significant volatility. In early 2021, the exchange rate peaked at around 1.22, but as COVID cases surged later in the year, the Euro dropped sharply, hitting 1.13 by the end of 2021. This decline can be linked to the heightened uncertainty in global markets as the pandemic dragged on and the economic recovery remained fragile.

The Euro’s Struggles in 2022

In 2022, the Euro came under even more pressure, falling below parity with the USD for the first time in two decades. The last time the Euro fell below parity with the US dollar before 2022 was in December 2002. This was during the early years of the Euro’s existence, shortly after it was introduced as a physical currency. A combination of rising inflation, geopolitical tensions (especially the war in Ukraine), and economic concerns drove the exchange rate down to around 0.99 in some months. I saw this as a particularly challenging time for the Euro, as it was clear that the economic impact of the pandemic was far from over.

Fun fact: When the Euro was first introduced as an electronic currency in 1999, it actually debuted below parity with the US dollar, starting at around $1.17 but quickly falling below $1 within its first year. It wasn’t until 2003 that the Euro consistently rose above the dollar, establishing itself as a major global currency.

Recovery in 2023

By 2023, things started to stabilize slightly. The Euro began to regain some ground, hovering around 1.03 to 1.05 for much of the year. Although this was still below pre-pandemic levels, it reflected a gradual recovery as global health conditions improved and economic activity picked up. The exchange rate’s improvement during this time suggests that the worst economic disruptions from the pandemic had passed, although inflation and other lingering effects remained.

Key Takeaways

- Initial Stability, Gradual Decline: I noticed that during the early stages of the pandemic, the Euro held steady, likely due to swift government interventions. However, as the pandemic persisted, the Euro began to weaken.

- Volatility During the Peak: The sharp increase in COVID-19 cases in late 2021 coincided with significant drops in the Euro’s value, illustrating the direct impact of pandemic-driven uncertainty on the currency market.

- Long-Term Effects and Partial Recovery: While the Euro struggled in 2022, even falling below parity with the USD, 2023 saw a modest recovery as the world adapted to post-pandemic realities.

Conclusion

This chart clearly shows how the COVID-19 pandemic impacted the Euro-USD exchange rate, with market volatility mirroring the rise and fall of case counts. It highlights how global health crises can have far-reaching consequences, affecting everything from currency values to broader economic trends.